-

Continue reading →: When Black Tie Becomes a Black Hole for Your Wallet

I have a female coworker who loves asking me for fashion advice but never actually follows it. It makes me wonder: do people really want advice, or do they just want an audience? She was recently invited to a family member’s black-tie wedding and immediately started complaining about the cost.…

-

Continue reading →: How Paying Off My Mortgage Sparked a Fitness Journey

On May 15, Mr. Cabbage and I made the final mortgage payment on our house. When I hung up with the loan officer (yes, they actually make you call and talk to a real live human), I sat there, stunned. That’s it? No confetti? No parade? Coal and Vanilla, our…

-

Continue reading →: 👗 Is Reselling Clothes Worth It?

Let me guess—you love fashion, your closet is overflowing, and you’ve thought, “Maybe I should just sell this stuff!” Maybe you already have a Poshmark or Mercari account. (You can visit mine here on Poshmark and here on Mercari). But the big question is: Is reselling clothes actually worth the trouble? I’ve been doing…

-

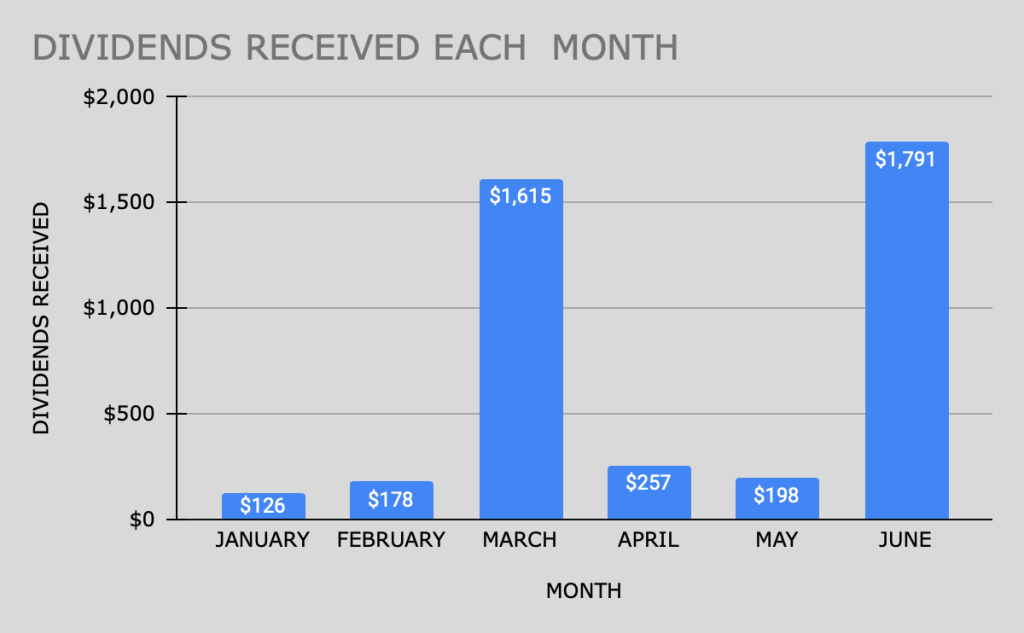

Continue reading →: 💸 Dividend Income: January–June 2025 Recap

Continue reading →: 💸 Dividend Income: January–June 2025 RecapAs we wrap up the first half of 2025, I wanted to take a moment to reflect on one of my favorite parts of personal finance—dividend income. Watching my money work for me while I sip coffee in vintage heels, a twirly dress, and two kittens race across the room?…

Hello,

I’m Lizzy

Welcome to Stilettos or Savings a place to balance on incredible heels and make smart financial choices in order to enjoy all of life’s pleasures!