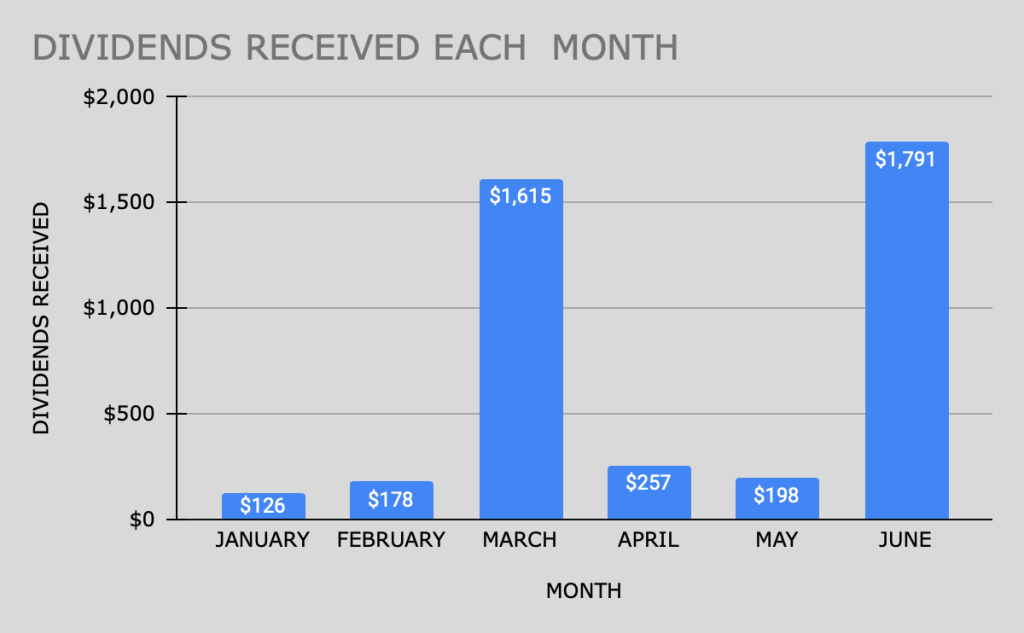

After the drama of March, April felt mellow. No wild market swings or emotional rollercoasters—just steady cash flow and the kind of consistency I like to see from my portfolio. While the total dividend haul was a much lower this month, passive income is passive income… and I’ll take every dollar.

Top Dividend Payers in April:

Here are the MVPs of April—these stocks and ETFs sent me the most cash this month:

* BND – $109.79 (Still not obsessed with bonds, but BND keeps showing up like a dependable ex who pays their half on time)

* RITM – $40.97 (High-yield and high-drama, but RITM delivered)

* PGIM – $27.18 (PGIM: low-key but loyal—like that coworker who brings snacks to every meeting)

Why It Works

April was quieter, but that’s the beauty of dividend investing: money keeps coming in whether the market is hot, cold, or emotionally unavailable. Even smaller months continue to add up—and since every dividend is reinvested, they’re working behind the scenes to grow my future income.

What’s Next?

Total dividends in April came to $257.36. Not flashy, but solid—and every month of consistent investing brings me one step closer to financial independence (and maybe a cat castle for Coal and Vanilla).

Stay consistent, reinvest, and let the market do what it does. See you in May!

Quick Disclaimer:

I’m just sharing what I’m doing—not giving financial advice. I’m not a certified advisor, planner, or anything official. Please do your own research or talk to a pro before making money moves.

Tell me what you think!