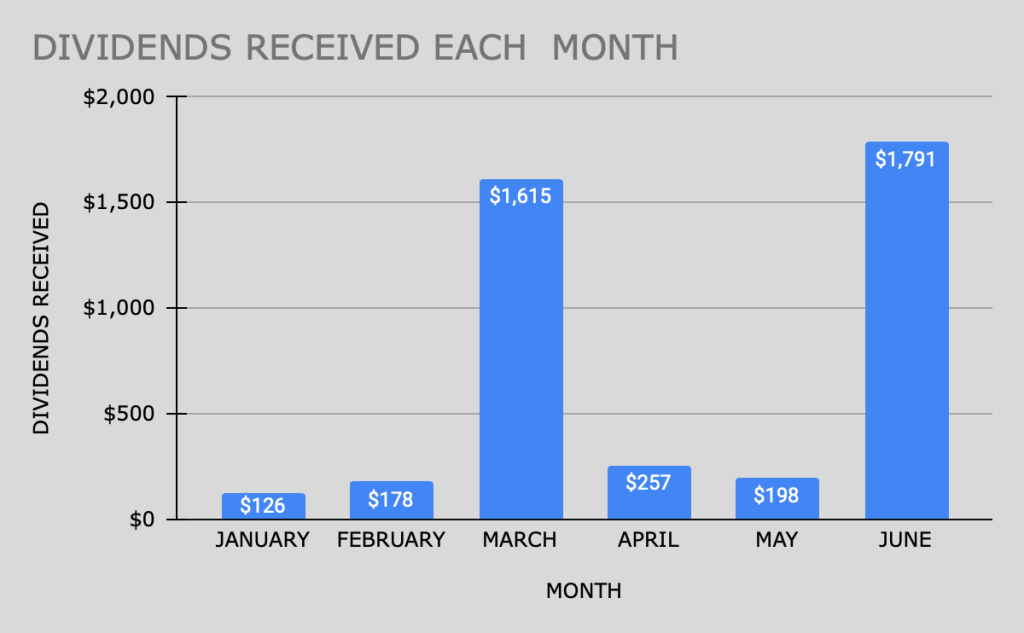

March was like a reality TV show for the stock market—lots of drama, a few shocking twists, and moments that made me question everything. While my investments were down $27,648.80 for the month… the dividends didn’t disappoint.

Top Dividend Payers in March (Based on Cold, Hard Cash)

Here are the stocks and ETFs that sent me the most cash this month—not the highest yields, but the biggest paydays:

• IVV – $399.59 (The S&P 500 just keeps paying me like a loyal friend)

• VEA – $265.86 (International exposure, consistent payout. VEA never disappoints)

• BND – $99.93 (I’m not obsessed with bonds, but BND is always on time)

• VYM – $131.95 (You can always count on VYM to send a nice check)

Why It Works

These aren’t the highest-yielding dividend stocks in my portfolio, but they’re the ones that showed up in March. The key to consistent passive income is a diversified portfolio that keeps paying you, no matter what the market is doing. And for me, every dollar gets reinvested—so these dividends keep working to generate even more income over time.

What’s Next?

March’s dividends came to a grand total of $1,614.73. For now, I’ll sit back, relax, and let these investments do the work—while Coal and Vanilla continue their freeloading ways.

Remember, try not to stress about the market’s ups and downs—just keep be consistent and keep on investing, and we’ll see what April brings!

Quick Disclaimer:

This is just me sharing my investing journey—not financial advice. I’m not a financial planner, advisor, or anything fancy like that. Always do your own research and consult a professional before making investment decisions!

Tell me what you think!